Fortunes can change quickly in the markets, and the obscure world of credit derivatives are no exception.

Subscribe now for unlimited access.

$0/

(min cost $0)

or signup to continue reading

Not that long ago, Qantas was a discarded junk rated airline, which was seeking a government bailout and had to fight tooth and nail to get its investment grade rating restored.

Meanwhile, imperious miner BHP Billiton was considered the most coveted of corporate borrowers, whose absence in the local market was lamented and then heralded when it finally returned.

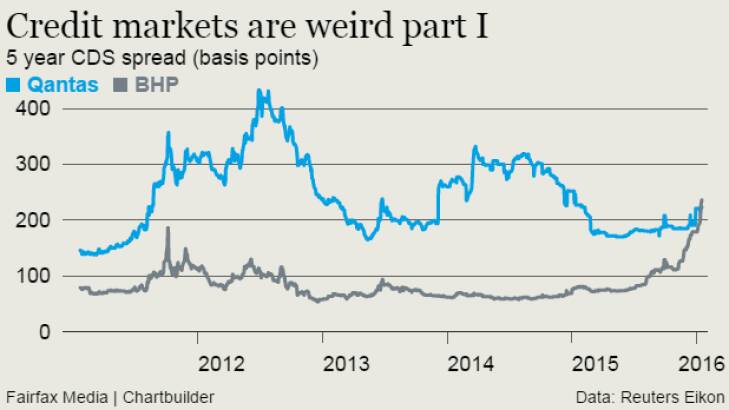

Now, remarkably the credit default swap markets are showing more love for Qantas than BHP.

The cost of insuring BHPs debt (as measured by its five-year CDS spread) has exploded, and it's now more expensive than the airline's, according to Reuters data.

Which is strange on a number of levels. For starters, BHPs debt is still rated by credit agencies (A+, but with a negative outlook) four notches higher than Qantas, (BBB-, stable).

And in the actual cash bond market, the yield on Qantas' bonds is still significantly higher than the yield on the most comparable BHP debt issue. In other words, BHP debt is still considered less risky than Qantas' in the cash market. (If you have seen new film The Big Short, you may know that there are often discrepancies between credit derivative markets and the actual bond markets they are linked to).

At any rate, despite gloomy market predictions for commodity prices, some investors see weakness in BHP's debt as a buying opportunity. The miner still has a strong balance sheet and generates billions of dollars of free cash flow, more than enough to cover its debt. In a note to clients this week, Real Investments fund manager Andrew Papageorgiou argued that BHPs implied asset base is worth vastly more than its debt, which at $30 billion, is about three times the miner's estimated EBITDA.

Papageorgiou reckons BHP's subordinated debt, which yields 6.5 per cent, offers "tremendous compensation for an A- rated security."

It is somewhat ironic that Qantas is benefiting from the same broad-based weakness in commodity prices that has smashed BHP. But get used to it, because this is the world we now live in.