Whether placing trades through an automated system or a discretionary approach, it often benefits traders to have a cohesive strategy. This series will walk you through building a complete strategy: This is part 2, The Time Frames of Trading.

Over this series of articles, we will walk traders through the multiple-step process of building a trading strategy. The first installment in the series discussed market conditions . This is the second entry, in which we will delve deeper into selecting a time frame for the strategy.

One of the most common questions from new traders is ‘What time frame works best?’

After all, there are quite a few different time frames we can work with, aren’t there?

Created with Marketscope/Trading Station II

Unfortunately, there isn’t an easy or direct answer to this question – as any time frame you choose is going to leave something to be desired. That ‘something’ is the fact that all time frames are lagging; only showing us past prices… which may not be indicative of future prices.

But we can still choose time frames conducive to our goals, and build an analytical approach so that we know the optimal time to employ our strategy and enter trades based on what it is that we want to get out of the market.

And if market conditions do change, risk and money management can help prevent these reversals from completely draining the trader’s account.

Use Time Frames that Match Your Goals

Often times, traders can get conflicting views of a currency pair by examining different time frames. While the daily might be showing an up-trend, the hourly can be showing a down-trend. But which way should we trade it?

This can provide conflicting signals and counter-productive unrest in the trader’s mind as they are attempting to line up trades. For this reasons, it’s important for the trader to plan the time frames they want to trade as they build their strategies.

In many cases, traders can benefit from using multiple time frames; in an effort to incorporate as much information as possible into their analysis.

Incorporating a longer time frame will allow the trader to see a ‘bigger picture’ of the currency pair so that they may get an idea of ‘general trends,’ or the sentiment that may exist; while the shorter time frame chart can be used for plotting the actual trade. This leads into a very popular permutation of technical analysis in which traders incorporate multiple time frames into their approach.

Multiple Time Frame Analysis

By utilizing multiple time frames in their analysis, traders are getting multiple vantage points into the currency pair(s) that they are looking to trade.

A common way of employing multiple time frame analysis is to use a longer-term chart to analyze the trend or general sentiment in the pair, and the shorter-term chart to enter into the trade. Below are two time frames commonly used by ‘swing traders,’ with the goal of keeping the trade open for anywhere from a few hours to a few weeks.

First, the trader will analyze the general trend in the pair by looking at the Daily Chart, and noticing that price is in the process of making ‘lower-lows,’ and ‘lower-highs.’

(Created with Trading Station 2.0/Marketscope)

After the trader has determined the trend, and in the above chart – the trend is decidedly to the down-side (this is determined from the successive lower-lows and lower-highs), the shorter term chart can be investigated so that the trader can look for an opportunity to enter.

The ‘swing-trader’ will often use the 4-hour chart to look for entries after grading the trend based on the Daily.

(Created with Trading Station 2.0/Marketscope)

In this case, the trader would be looking to sell as the Daily chart exhibited a strong down-trend. After dialing in on the 4-hour chart, the trader would notice that a portion of the downtrend had been recently given back as price went up.

Traders can look at this as an opportunity to sell the strong trend seen on the Daily, at a relatively high price (as evidenced on the 4-hour chart).

Which Time Frames Work Best (with each other?)

When using multiple time frames, it’s important to remember that not every time frame will work together accordingly.

If I’m using the daily chart to read trends, but the one-minute chart to enter trades; there is a large element of disconnect between the two time frames. Each daily candle has approximately 1440 one-minute candles, so when I look at the one-minute chart – I am often only seeing what would constitute, at max, one candle on the daily chart. It would be haphazard to read trends on the daily and attempt to place trades on the one-minute chart due to this disconnect.

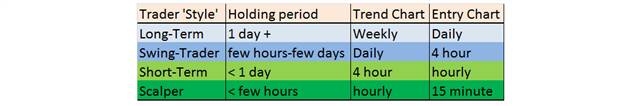

We suggest a ratio of 1:4 to 1:6 between the trend and the entry chart when employing multiple time frame analysis. So, if a trader is looking to enter on the hourly chart, the 4-hour chart can be used for grading the trend. If a trader wanted to enter on the 15 minute chart, the hourly chart can be used for reading sentiment. Below is a table with some common time frames for analysis.

Multiple Time Frame Analysis Intervals; prepared by James Stanley

Building a Multiple Time Frame Strategy

Many traders are familiar with the term ‘the trend is your friend.’ One of the more effective ways of analyzing trends is using a longer time frame than the one being used to plot trades.

Let’s say, for example – that a trader wanted to enter trades based on Slow Stochastics (as we had outlined in the article How to Trade with Slow Stochastics); but only after confirming trends with the 200 period Simple Moving Average.

So – if price is below the 200 period Simple Moving Average, our trader only wants to look at sell opportunities; and those will be entered with Stochastic crossovers of the %K and %D lines. If price is above the 200 period Simple Moving Average – our trader only wants to buy; and those trades will be entered when the %K crosses above %D on Stochastics.

From the table above, we can see that traders wanting to enter trades on the hourly chart can properly employ multiple time frame analysis by using the 4 hour chart to analyze trends.

So, the first step for the trader is they want to identify the trends; and once again, for the trader using the hourly chart to enter trades the 4 hour chart can provide trend analysis. Our trader pulls up a 4 hour chart and notices that price is, and has been below the 200 period Simple Moving Average; so our trader would only want to be looking at sell opportunities (at least until price went above the 200 on the hourly, in which they would begin looking for long positions).

(Created with Trading Station 2.0/Marketscope)

After the trader gets comfortable with trend analysis on the 4 hour chart, they can go down to the hourly to begin looking for trade entries. And because the trend was down on the 4 hour chart, our trader is only looking at potential sell positions.

(Created with Trading Station 2.0/Marketscope)

In the chart above, you can see the numerous opportunities that our trader would have had to sell the currency pair based on stochastics. Surely, not every sell position would have worked out profitably for the trader; but that is an impossible goal, as completely avoiding losses is inconceivable. Multiple time frame analysis, however, can increase the probabilities with which one is employing their strategy as it offers the ‘bigger picture view’ from the longer-term chart so that traders can properly grade sentiment and trends.

--- Written by James B. Stanley

To contact James Stanley, please email Instructor@DailyFX.Com. You can follow James on Twitter @JStanleyFX.

To be added to James’ distribution list, please send an email with the subject line “Notification,” to Instructor@DailyFX.com.

How to Build a Strategy, Part 1: Market Conditions

Trading Psychological Whole Numbers

Subscribe now for unlimited access.

$0/

(min cost $0)

or signup to continue reading