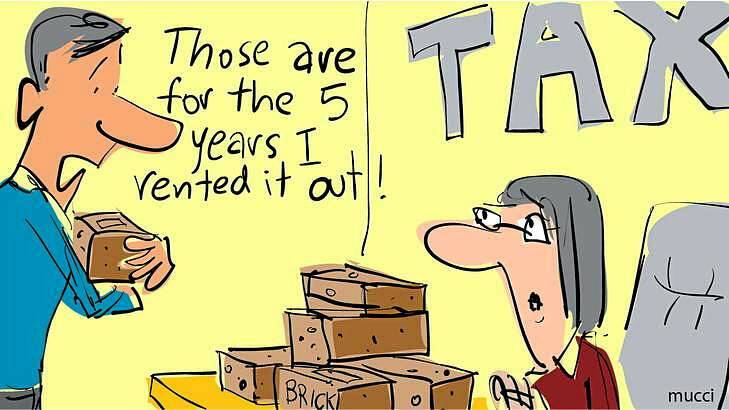

Q I built a house in September 2008, which remained vacant until January 2009 then was rented out for five years. I moved into the house in April and intend to live in it for 12 months before putting it on the market in April 2014. Am I eligible for a full capital gains exemption under the six year rule? I did not have any other main residence during this time.

Subscribe now for unlimited access.

$0/

(min cost $0)

or signup to continue reading

A As the property was rented before being occupied by yourself, you will be liable for CGT on a pro-rata basis. Therefore if it was owned for a total of six years, and occupied for just one, you would be liable for CGT on 5/6ths of the gain.

This would be reduced by the 50 per cent discount for owning the property for more than a year.

Q I took a massive hit on the share market a few years ago, and I'm about to sell a rental property that has positive capital growth. Can I offset the losses through property, and for how many years can I do this?

A Providing the share market losses were capital losses, not trading losses, they can be offset against future capital gains on sale of investments. There is no time limit.

Q My father is 81 and recently moved to an aged-care facility because of advanced dementia. No bond is payable, but there is a shortfall of about $1000 a month between the daily rates and his pension. We are in the process of selling his family home - we hope to net $380,000 after fees etc. Apart from keeping aside about $20,000 for fees and other outlays, we are unsure how the deeming works, and appropriate investments to make on dad's behalf.

A It seems your father has entered a high-care facility where an accommodation charge is payable in lieu of an accommodation bond. Upon receipt of the proceeds of his home, the money will be added to any existing financial assets and deemed to earn income.

The current deeming rates are 2.5 per cent on the first $46,600 and 4 per cent on assets above this, so if your father has $20,000 of existing financial assets and nets $380,000 from the sale of the home his deemed income will be $589 a fortnight. The deemed income and your father's pension would be used to determine his ability to contribute towards his cost of care through an income-tested fee.

If your father is in receipt of the age pension, the assets will also be assessed against the non-homeowner asset test threshold of $339,250 - the test that produces the lowest pension amount will determine the pension amount he receives.

Payment of an accommodation charge would make your father eligible to keep and rent the home, with asset and income-test exemptions being applied, and may assist in providing the necessary cash flow.

However, if the sale is necessary then strategies to reduce the level of assessable assets, such as gifting and prepaying a funeral, or purchasing a funeral bond, in conjunction with strategies to reduce the level of assessable income, such as establishing a family trust, would be worth exploring with a specialist adviser.

Q I am about to turn 55 and would like to retire on my birthday. I am in a defined benefits scheme where I can take a lump sum of $1.4 million, or an indexed pension for life of $100,000 a year guaranteed by the Commonwealth of Australia. If I die my wife would receive 60 per cent of the pension - she is 50 and has no super or savings. I own my house valued at $1.7 million, other property worth $600,000, additional super worth $150,000, and other liquid assets of $400,000. As I have no debt, the indexed pension looks very attractive. I would appreciate your thoughts.

A The pension option certainly looks attractive, especially in view of the young ages of your wife and yourself.

Major factors in your decision should be your confidence in handling a lump sum of $1.4 million, and whether it is important to you to leave a substantial estate to your beneficiaries. The fact that you think the pension looks attractive makes me believe you'll be happy with that option, particularly as you have substantial assets outside super now.

Q Recently you suggested a good strategy for paying a mortgage is to pay $900 a month for each $100,000 owing. I am interested in understanding the assumptions used as the basis of this recommendation, and whether this advice needs to be fine-tuned in view of low interest rates of under 6 per cent.

A That is the figure that will pay the mortgage back in about 14 to 15 years. Because of the way the mathematics work the interest rate matters less and less as the term shortens.

It means you give yourself a safety buffer if rates rise, but will pay the loan back relatively quickly if they stay at present levels or even fall.